Unlocking Your Property Equity: Smart Strategies for Homeowners Ready to Make Moves

Your Home Is More Than Shelter

For most Australians, their property represents their single largest asset. Yet surprisingly few homeowners fully understand how to leverage that equity strategically.

The equity sitting in your home can fund renovations, consolidate debt, finance investments, or cover major life expenses. Accessing it wisely requires understanding your options and working with the right professionals.

This guide explores practical approaches to unlocking property equity. Whether you're eyeing an investment opportunity or need funds for personal goals, these strategies help you make informed decisions.

Understanding Home Equity Basics

Equity is simply the difference between your property's current value and what you still owe. If your home is worth $1.2 million and your mortgage balance sits at $700,000, you have $500,000 in equity.

That equity has grown through your mortgage payments and, hopefully, property appreciation. It represents real wealth, even if it feels abstract while tied up in bricks and mortar.

Accessing this equity isn't free money, of course. You're borrowing against your asset, which means careful consideration of costs, risks, and purposes.

The Refinancing Route

Refinancing your existing mortgage to access equity remains the most common approach. You essentially take out a new, larger loan and receive the difference as available funds.

This method often secures competitive interest rates since your home serves as security. Lenders view refinanced mortgages favourably when loan-to-value ratios remain reasonable.

The process involves property valuation, income verification, and standard lending assessments. If your financial situation has changed significantly since your original loan, approval isn't guaranteed.

When Traditional Refinancing Doesn't Fit

Sometimes conventional refinancing isn't suitable or available. Perhaps your income has become irregular, you've recently changed jobs, or you need funds faster than traditional approval timelines allow.

Self-employed borrowers and those with non-standard income often face particular challenges. Banks apply conservative assessments that don't always reflect genuine repayment capacity.

These situations don't necessarily mean equity access is impossible. Alternative lending products exist specifically for circumstances where mainstream options fall short.

Exploring Second Mortgages

Second mortgages provide another pathway to equity access without disturbing your existing home loan. This approach keeps your current mortgage intact while adding a separate secured loan.

The appeal is straightforward. If you've locked in a favourable rate on your primary mortgage, refinancing means losing that advantage. A second mortgage preserves your existing arrangement while still accessing equity.

For homeowners exploring this option, understanding how second mortgage loans work helps clarify whether they suit your situation. These products typically carry higher interest rates than first mortgages but offer flexibility and speed that traditional refinancing cannot match.

Second mortgages work particularly well for specific purposes like business investment, property deposits, or bridging finance. The key is ensuring the use of funds justifies the higher borrowing costs involved.

Calculating What You Can Actually Access

Lenders won't let you borrow against 100% of your equity. Most apply maximum loan-to-value ratios, typically allowing borrowing up to 80% of your property's value across all secured debts.

Using our earlier example of a $1.2 million property with a $700,000 mortgage, 80% LVR means maximum total borrowing of $960,000. Subtract your existing $700,000 debt, and you could potentially access around $260,000.

Some lenders offer higher LVRs with lenders mortgage insurance, but this adds cost. Running these calculations before approaching lenders sets realistic expectations.

The Purpose Matters

What you're accessing equity for significantly influences which products suit your needs and how lenders assess your application.

Investment purposes, whether property, business, or shares, may offer tax advantages since interest becomes potentially deductible. Consult accountants before assuming deductibility applies to your situation.

Lifestyle expenditures like renovations, holidays, or vehicle purchases don't offer tax benefits. They can still represent valid reasons to access equity, provided you understand the true cost over loan terms.

Debt consolidation combines multiple debts into one secured loan with lower interest rates. This strategy reduces monthly payments but extends debt over longer periods, potentially increasing total interest paid.

Why Professional Guidance Matters

The equity access landscape involves numerous products, lenders, and structures. Navigating it alone risks missing opportunities or selecting unsuitable arrangements.

Mortgage brokers access dozens of lenders and hundreds of products that direct borrowers never see. Their market knowledge identifies options aligned with your specific circumstances.

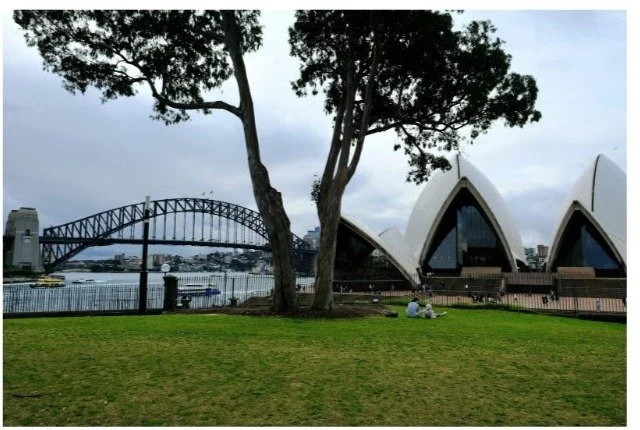

Finding the best mortgage broker in Sydney or your local area means working with professionals who understand both mainstream and alternative lending. Quality brokers assess your complete situation before recommending products, rather than pushing whatever pays highest commissions.

The right broker explains trade-offs honestly. They'll tell you when accessing equity doesn't make sense, not just how to do it.

Interest Rate Considerations

Equity access loans carry various rate structures with significant long-term cost implications. Understanding these differences prevents expensive surprises.

Variable rates fluctuate with market conditions. They typically offer flexibility features like extra repayments and redraw facilities but create payment uncertainty.

Fixed rates provide certainty for specified periods. This predictability aids budgeting but limits flexibility and may include break costs if you need to exit early.

Split arrangements combine both approaches, hedging your bets somewhat. The optimal structure depends on your risk tolerance and how long you expect to hold the debt.

Fees and Costs to Anticipate

Beyond interest rates, equity access involves various fees that affect true borrowing costs. Ignoring these distorts your cost-benefit analysis.

Application fees, valuation costs, and legal fees apply to most products. Some lenders waive certain charges, making comparisons more complex than headline rates suggest.

Ongoing fees, including annual charges and package fees, accumulate over loan terms. Low rates with high fees sometimes cost more than higher rates with minimal charges.

Discharge and exit fees apply when paying out loans. Factor these into any strategy involving short-term borrowing or anticipated property sale.

Risks Worth Considering

Borrowing against your home carries inherent risks that deserve serious consideration. Your property secures the debt, meaning default consequences are severe.

Increasing debt levels reduce your equity buffer. Property values can fall, potentially leaving you owing more than your home is worth in extreme scenarios.

Higher repayments strain household budgets. Ensure you can comfortably service additional debt even if interest rates rise or income decreases.

Borrowing for investment introduces specific risks tied to investment performance. The borrowed funds must generate returns exceeding borrowing costs to make financial sense.

Making Your Decision

Accessing home equity isn't inherently good or bad. The wisdom depends entirely on your circumstances, purposes, and execution.

Start by clarifying what you want to achieve and why equity access specifically makes sense. Alternative approaches might serve your goals with less risk.

Run realistic numbers including all costs, not just optimistic projections. Conservative assumptions protect against disappointing outcomes.

Seek professional advice before committing. Mortgage brokers, accountants, and financial planners each offer perspectives that improve decision quality.

Taking the Next Step

Your property equity represents significant financial resources that can support various life goals. Accessing it strategically creates opportunities that might otherwise remain impossible.

The key lies in understanding your options thoroughly before committing. Different products suit different situations, and what works brilliantly for one homeowner might poorly serve another.

Take time to research, calculate, and consult. Your future self will appreciate the careful approach to decisions involving your most valuable asset.